An Unbiased View of Tulsa Bankruptcy Lawyer

An Unbiased View of Tulsa Bankruptcy Lawyer

Blog Article

Our Tulsa Bankruptcy Legal Services Ideas

Table of ContentsMore About Bankruptcy Lawyer TulsaOur Chapter 7 Vs Chapter 13 Bankruptcy PDFsThe Single Strategy To Use For Top-rated Bankruptcy Attorney Tulsa OkGetting My Experienced Bankruptcy Lawyer Tulsa To WorkGet This Report about Tulsa Debt Relief Attorney

The stats for the other major type, Chapter 13, are also worse for pro se filers. Suffice it to claim, talk with an attorney or two near you who's experienced with personal bankruptcy legislation.Numerous attorneys also supply free consultations or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is indeed the appropriate option for your circumstance and whether they assume you'll qualify.

Advertisements by Money. We might be compensated if you click this ad. Ad Since you've decided bankruptcy is without a doubt the appropriate course of action and you with any luck cleared it with a lawyer you'll require to get going on the documents. Before you dive into all the main personal bankruptcy types, you need to get your own papers in order.

Tulsa Bankruptcy Consultation - An Overview

Later down the line, you'll in fact require to confirm that by divulging all type of details about your financial events. Here's a standard list of what you'll require when driving in advance: Recognizing papers like your motorist's permit and Social Safety card Tax returns (as much as the past four years) Proof of earnings (pay stubs, W-2s, self-employed revenues, earnings from properties as well as any type of income from government benefits) Bank declarations and/or pension statements Proof of worth of your possessions, such as vehicle and genuine estate appraisal.

You'll want to recognize what kind of financial debt you're trying to resolve.

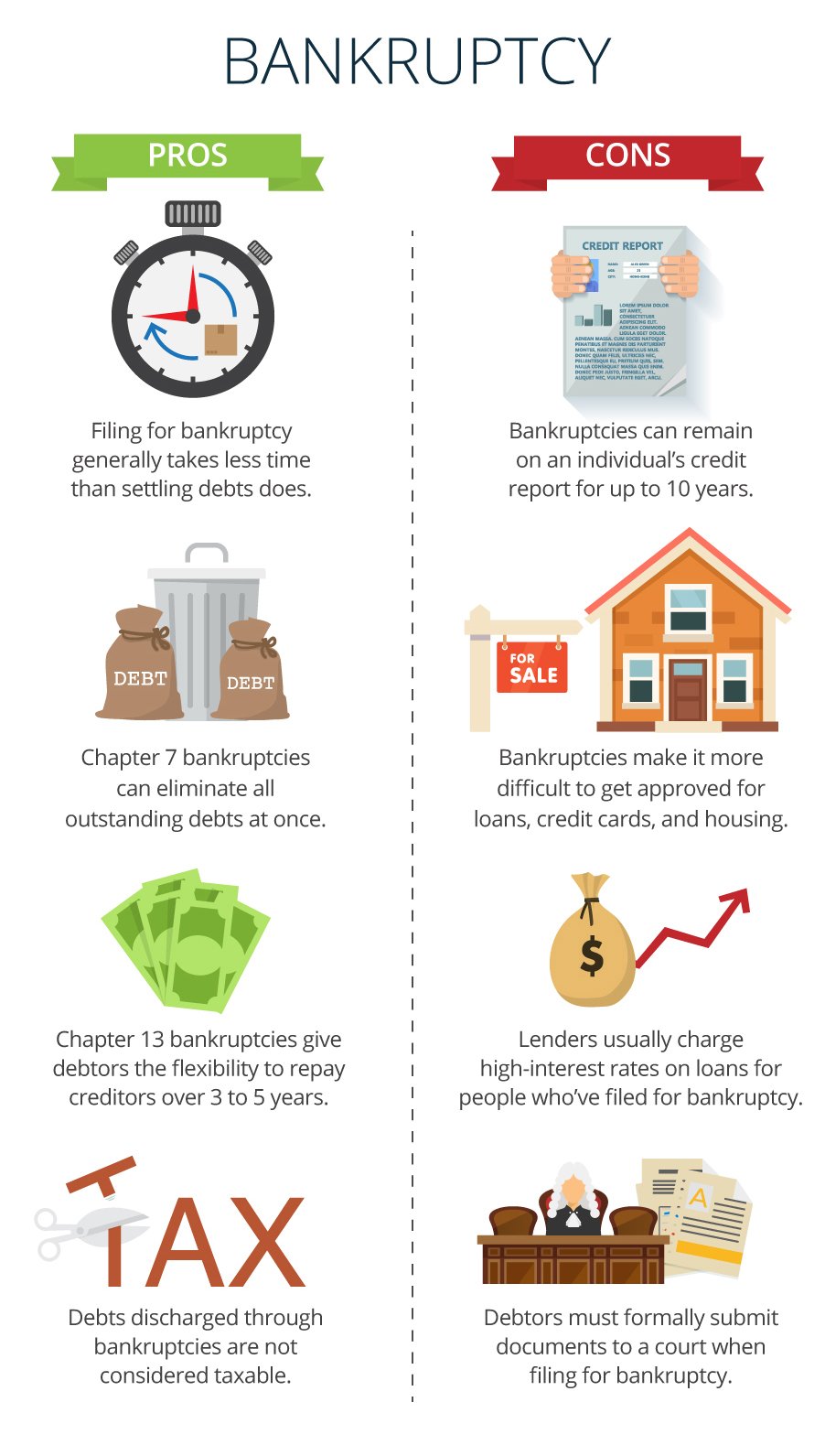

You'll want to recognize what kind of financial debt you're trying to resolve.If your income is as well high, you have one more alternative: Chapter 13. This choice takes longer to fix your financial obligations since it calls for a lasting repayment plan normally three to five years before several of your staying debts are wiped away. The declaring process is likewise a great deal much more complicated than Phase 7.

Fascination About Chapter 7 Bankruptcy Attorney Tulsa

A Phase 7 bankruptcy remains on your credit record for ten years, whereas a Phase 13 bankruptcy drops off after 7. Both have lasting effects on your credit rating, and any brand-new debt you get will likely feature higher rates of interest. Before you submit your insolvency types, you need to first complete a required program from a credit score counseling agency that has been authorized by the Department of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The course can be completed online, in individual or over the phone. You need to complete the program within 180 days of filing for bankruptcy.

Everything about Affordable Bankruptcy Lawyer Tulsa

Examine that you're filing with the proper one based on where you live. If your irreversible residence has actually moved within 180 visit the website days of filling up, you must file in the district where you lived the higher portion of that 180-day duration.

Typically, your personal bankruptcy attorney will certainly function with the trustee, however you may require to send the individual papers such as pay stubs, tax returns, and financial institution account and credit report card statements directly. An usual misunderstanding with bankruptcy is that as soon as you file, you can stop paying your debts. While insolvency can aid you clean out several of your unsafe financial debts, such as past due clinical costs or individual lendings, you'll desire to maintain paying your regular monthly repayments for guaranteed financial debts if you desire to keep the residential property.

Some Ideas on Tulsa Bankruptcy Filing Assistance You Need To Know

If you're at threat of foreclosure and have tired all various other financial-relief alternatives, then submitting for Chapter 13 might delay the repossession and aid save your home. Ultimately, you will still need the earnings to continue making future home loan repayments, in addition to repaying any kind of late payments throughout your layaway plan.

The audit can delay any type of financial like this obligation relief by numerous weeks. That you made it this far in the procedure is a good indicator at least some of your financial obligations are qualified for discharge.

Report this page